Global Sodium Lauryl Ether Sulfate (SLES) Market: Key Highlights

- In terms of value, the global sodium lauryl ether sulfate (SLES) market is anticipated to expand at a CAGR of ~ 4% from 2019 to 2027.

- Sodium lauryl ether sulfate is an anionic surfactant with a milder effect. It does not irritate the skin, unlike other anionic surfactants, including sodium lauryl sulfate (SLS). Thus, sodium lauryl ether sulfate the preferred surfactant in personal care applications such as skin care and hair care.

- The detergents & cleaners segment accounted for a prominent share of the SLES market in 2018, owing to the rise in the demand for laundry detergents and industrial cleaners, and rapid industrial development, primarily in developing economies.

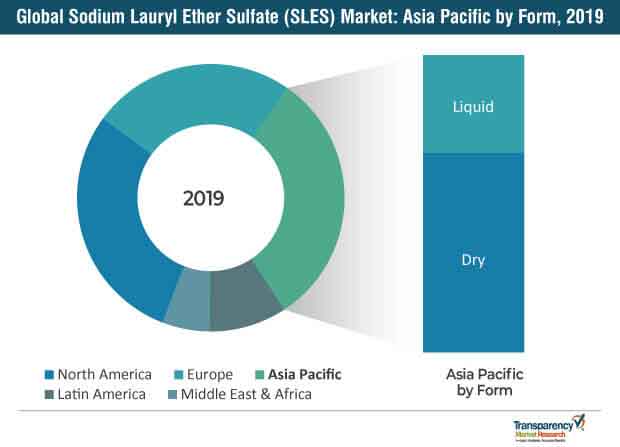

- The dry form segment dominated the global sodium lauryl ether sulfate market in 2018. However, the demand for the liquid form of SLES is anticipated to increase rapidly during the forecast period, owing to the rise in the popularity of liquid detergents and dishwashers.

- The sodium lauryl ether sulfate market in Asia Pacific is estimated to expand at a CAGR of ~ 5.0% during the forecast period, due to the vast growth in end-use industries such as personal care.

Planning to lay down strategy for the next few years? Our report can help shape your plan better

Rise in Demand for Personal Care Products to Drive the Global SLES Market

- Significant improvement in lifestyles and standard of living, primarily in developing economies, has fuelled the demand for personal care products. Increase in popularity of e-Commerce and large base of young population in developing countries have boosted the demand for modern personal care products.

- The global personal care products industry is anticipated to expand at a CAGR of ~ 6% during the forecast period. The personal care products market in India is estimated to expand at a CAGR of ~ 8%, while that in Africa and the Middle East is likely to expand at a CAGR of ~ 4% during the forecast period.

- The adoption of sodium lauryl ether sulfate in personal care products has increased significantly due to its mildness on the skin and its chemical stability as compared to other anionic surfactants such as sodium lauryl sulfate, alkylbenzene sulfonates, and phosphoric acid esters.

- Rise in the demand for personal hygiene products such as toilet soaps and hand wash in developing countries, led by the increase in awareness programs regarding personal hygiene by international and local bodies is driving the demand for SLES, considering its cost effectiveness and superior performance as compared to other alternatives.

Rising Trend of Sulfate-free Personal Care Products Likely to Pose Significant Challenges

- Products with sulfate ingredients are mainly utilized to remove natural dyes. Thus, personal care products with sulfate ingredients are considered as very harsh materials for use.

- Hair care products containing sulfate are not recommended for kinky, curly, or coily hair, as sulfate tends to dry the hair.

- Personal care products with SLES content are considered harsh for human usage. Thus sulfate-free personal care products are gaining popularity in the global market. Key players are focusing on developing organic-based surfactants to replace conventional petroleum-based surfactants.

- Thus, the rising trend of sulfate-free personal care products is expected to hamper the sodium lauryl ether sulfate market across the globe

Asia Pacific Expected to be a Highly Lucrative Region of the SLES Market

- In terms of value, Asia Pacific held a major share of more than 25% of the global sodium lauryl ether sulfate market in 2018.

- Developing economies of Asia Pacific such as China and India have experienced significant penetration of washing machines, owing to improvement of lifestyles and enhanced buying capacities of consumers. This has boosted the demand for efficient laundry detergent solutions in the region, thereby driving the demand for SLES.

- The demand for high-end skin care and hair products is rising significantly in Asia Pacific. The establishment of the e-Commerce industry and high use of the Internet in countries such as China and India have enabled the youth to access advanced cosmetics and other personal care products. Thus, the demand for various upgraded personal care products has been increasing, due to the rise in awareness about personal hygiene. As such, the versatility of sodium lauryl ether sulfate in the production process of personal care products can be ascribed to the increase in the demand for SLES.

Global Sodium Lauryl Ether Sulfate (SLES) Market: Key Developments

- In 2018, Stepan Company signed an agreement with BASF Mexicana, S.A. DE C.V. to acquire the latter’s surfactant production facility in Ecatepec, Mexico. The facility has annual production capacity of 50,000 metric tons, with a 12,400 square feet warehouse space.

- In 2017, Clariant opened a new research and development laboratory in Tokyo, Japan. The facility is located in Tokyo Metropolitan Industrial Technology Research Institute (TIRI). The newly opened R&D lab is dedicated to meet the high demand for personal care products in Japan.

Global Sodium Lauryl Ether Sulfate (SLES) Market: Competition Landscape

- Large numbers of organized and unorganized players operate in the global SLES market. Thus, the sodium lauryl ether sulfate market is fragmented. Huntsman International LLC, Kao Corporation, Stepan Company, and Galaxy Surfactant Ltd constituted around 20% share of the global SLES market in 2018.

- Other key players operating in the global SLES market are Solvay, BASF SE, Evonik Industries AG, Taiwan NJC CORPORATION, Quimicos del Cauca S.A.S., Clariant, Oxineto, Croda International Plc, Godrej Industries Limited, and Nouryon.