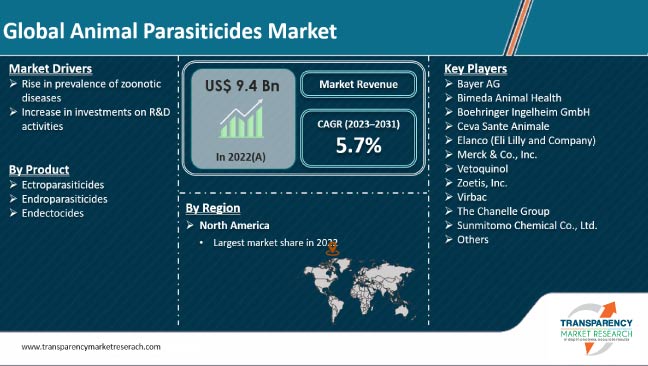

The global animal parasiticides market was valued at US$ 5,606.8 Mn in 2017 and is projected to expand at a cumulative annual growth rate (CAGR) of 5.5% from 2018 to 2026 according to a new report published by Transparency Market Research (TMR) titled “Animal Parasiticides Market: Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2018–2026”. The report suggests that increase in number of livestock farms and rise in demand for meat and animal byproducts are expected to boost the animal parasiticides market between 2018 and 2026. North America and Europe are projected to dominate the global market owing to the rise in adoption rate of companion animals and increase in demand for meat. Moreover, high adoption rate of animal parasiticides for instant treatment planning by veterinary doctors as well as researchers is also likely to fuel the market in North America and Europe during the forecast period. The market in Asia Pacific is projected to expand at a significant growth rate during the forecast period. Expansion of the market in Asia Pacific is attributed to the large cultivation base of food producing animals in the countries in Southeast Asia, rising number of pig population, and investment by major players for developing production units in the region. The market for animal parasiticides in Latin America is likely to expand at a moderate growth rate during the forecast period.

Get PDF Sample Copy of Report: (Including TOC, List of Tables & Figures, Chart) : https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=10841

Zoonotic infection and adoption rate of companion & food-producing animals is expected to fuel global market

The global animal parasiticides market is projected to be potentially driven by the increase in adoption rate of companion animals and production of food-producing animals in farms. Animal parasiticides provide diverse benefits for treatment of zoonotic diseases, which can be used by veterinary physicians and hospital staff. Key players offering animal parasiticides are developing value added features such as effective spray, dips, collars, etc. The new features or technological developments in parasiticides applications reduce the overall application cost and thus, improves the overall effectiveness and efficiency of food-producing animal production practices. Companies are focusing on the development of parasiticides chemical constituents for major diseases such as malaria in animals and Lyme disease. Other value-added features responsible for the expansion of the animal parasiticides market include expansion of biotechnology industries for research and development on zoonotic diseases, rise in expenses for R&D development, and rising government initiatives in funding societies for development in agriculture field, which improves the development of animal parasiticides globally.

Ectoparasiticides is projected to be highly lucrative deployment mode

Based on product, the ectoparasiticides segment is anticipated to have a prominent share of the market, in terms of value, by 2026. The segment is projected to expand due to rise in infestation of fleas, ticks, and other ectoparasites to companion animals and livestock, which increases the chances of bacterial, viral, and parasitic disease transmission to humans. Therefore, the usage of ectoparasiticides is inevitable and important for pets and cattle. These factors are expected to drive the segment during the forecast period. The ectoparasiticides segment is estimated to hold a major market share by the end of 2018 due to the increase in broader cross-protective immunity. The ectoparasiticides segment is expected to expand by 2026 due to increase in company’s focus on R&D expenditures and recent allocations of resources, which is also estimated to increase the operating cash ?ow to fund future growth investments. For instance, in 2017, Zoetis Inc. invested US$ 382 Mn to shape new innovation in the animal health industry. These are a few factors that are likely to fuel the ectoparasiticides segment during the forecast period.

Companion animals’ species dominates the market and the segment is estimated to expand at a significant CAGR during the forecast period

In terms of species, the companion animals segment accounted for a leading share of the global animal parasiticides market. The segment is estimated to gain market share by the end of 2026 and expand at a CAGR more than 6% during the forecast period. Expansion of specialized R&D production units by key players in major countries worldwide and increasing adoption rate of pets as companion, beast of burden, etc., have led to the prominent share held by the companion animals segment of the global animal parasiticides market. Increase in gastrointestinal parasitism and zoonotic diseases among pets is likely to drive the animal parasiticides market during the forecast period. High prevalence and incidence rates of zoonotic diseases in pets has led to an increase in pet owners’ visits to veterinary hospitals. These factors are expected to fuel the companion animals segment between 2018 and 2026.

REQUEST FOR COVID19 IMPACT ANALYSIS – https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=10841

Asia Pacific represents potential business development opportunity

North America and Europe accounted for a key share of the global animal parasiticides market in 2017. They are likely to gain market share by the end of 2026. High consumption of meat and production of livestock or food-producing animals have contributed to the leading share held by these region in the global animal parasiticides market. Asia Pacific is projected to be a highly attractive market for animal parasiticides, and is likely to exhibit a significant attractiveness index. The market in Asia Pacific is projected to expand at a high CAGR of 6.4% during the forecast period due to increasing trading policy of meat in emerging economies such as India and China. Rise in adoption of companion animals, increase in number of production units of food-producing animals such as swine and poultry, and high consumption of meat in countries such as Japan, Australia & New Zealand, Malaysia, Singapore, and Taiwan are likely to fuel the animal parasiticides market in Asia Pacific during the forecast period. The market in Latin America is anticipated to expand at a moderate growth rate during the forecast period due to increasing production of pigs in Argentina and investment of government funding for research and development of parasiticides in Brazil.

Key trend of research and development & acquisition among leading players to increase geographic presence has been observed in last few years

The report also provides profiles of leading players operating in global animal parasiticides market. Boehringer Ingelheim GmbH, Ceva Santé Animale, Elanco (Eli Lilly and Company), Merck & Co., Inc., and Zoetis, Inc. are major players operating in the global animal parasiticides market, accounting for significant market share. Companies operating in the animal parasiticides industry are aiming to increase their geographic presence by means of strategic acquisition and collaboration with leading players in respective domains and geography. In January 2015, Elanco (Eli Lilly) completed the acquisition of Novartis Animal Health (Novartis AH) in an all-cash transaction for US$ 5.28 Bn. The acquisition has provided Elanco with a greater commercial presence in the companion animal and swine markets. Other prominent players operating in the global animal parasiticides include Bimeda Animal Health, Virbac, Sunmitomo Chemical Co., Ltd. The Chanelle Group, Vetoquinol, and Bayer AG.

More Trending Reports by Transparency Market Research – https://www.prnewswire.com/news-releases/cholesterol-and-triglyceride-abnormalities-on-a-rise-driving-dyslipidemia-drugs-market-to-higher-trajectory-tmr-301024637.html